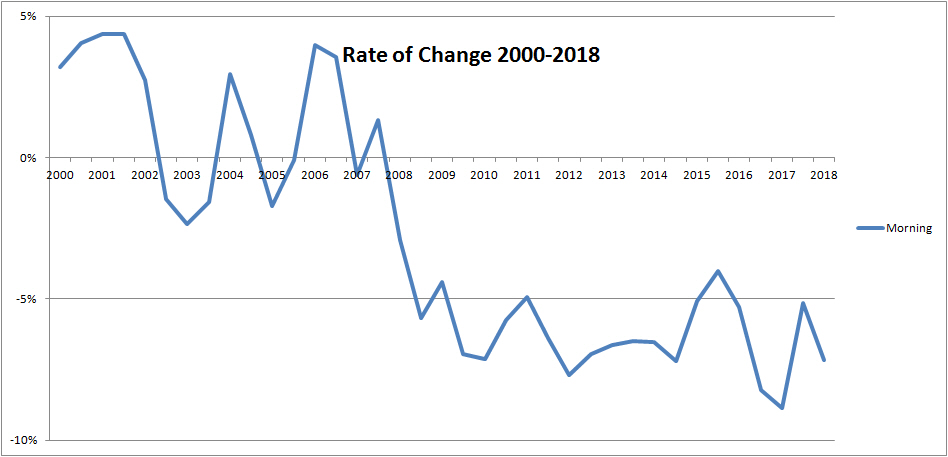

The ABC’s for the first half of 2018 were released earlier today. It shows that the newspaper market had contracted by a further 7.1% over the year. The market annual rate of decline hasn’t been below -6% since 2009 and that’s a statistic that doesn’t need further commentary. The Morning market was down slightly more than the Sunday.

The stark reality for the industry is that newspaper circulation has halved over the past decade alone.

| Market | JJ 2018 | JJ 2017 | Diff ‘000 | Diff % |

| Total Sunday | 577,937 | 621,119 | -43,182 | -7.0% |

| Total Morning | 384,618 | 418,958 | -34,339 | -8.2% |

| Total Market* | 2,939,714 | 3,194,145 | -249,217 | -7.8% |

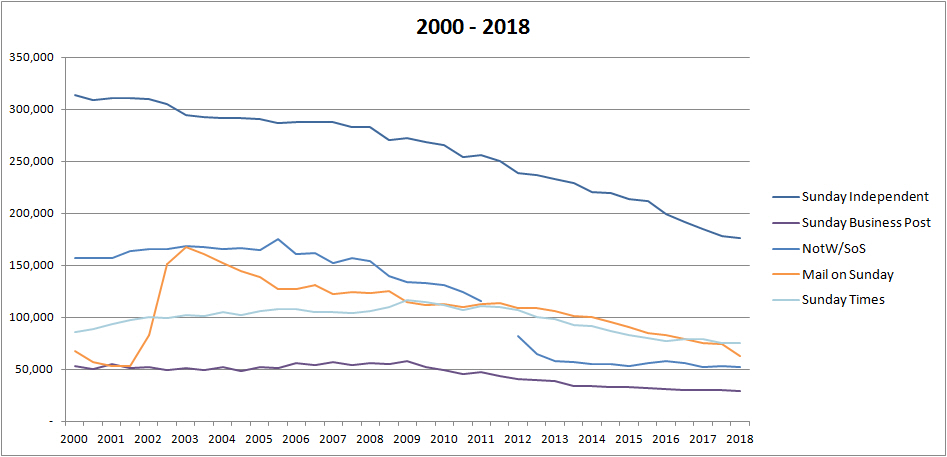

Sunday Market

The Sunday market now stands at 578,000 copies per day, a decrease of 43,000 on the same period in 2017. It represents a drop of 7.0% over the year and continues a worrying trend of year on year declines with no signs of any slowing (see the Sunday trend in the Annual Rate of Change chart below) and actually, the trend seems to have settled between 6% and 8% over the past five years.

| Publication | JJ 2018 | JJ 2017 | Diff ‘000 | Diff % |

| Sunday Independent | 176,580 | 185,080 | -8,500 | -4.6% |

| Sunday World | 130,083 | 143,503 | -13,420 | -9.4% |

| Sunday Business Post | 28,701 | 30,202 | -1,501 | -5.0% |

| Daily Star Sunday | 14,611 | 15,366 | -755 | -4.9% |

| The Sun (Sunday) | 52,647 | 52,124 | 523 | 1.0% |

| Irish Sunday Mirror | 21,181 | 22,931 | -1,750 | -7.6% |

| The People | 7,753 | 8,684 | -930 | -10.7% |

| Total Tabloid | 226,274 | 242,608 | -16,333 | -6.7% |

| Sunday Express | 2,739 | 2,943 | -204 | -6.9% |

| Mail on Sunday | 62,725 | 75,144 | -12,419 | -16.5% |

| The Observer | 4,174 | 4,543 | -369 | -8.1% |

| Sunday Telegraph | 1,605 | 1,941 | -336 | -17.3% |

| Sunday Times | 75,138 | 78,658 | -3,520 | -4.5% |

| Total Sunday | 577,937 | 621,119 | -43,182 | -7.0% |

Given the scale of the market drop, the Sunday Independent did better than the market average. Circulation stands at 176,500 down 5% on the same period last year. Beneath the surface, there was no real change in their bulks so the figures are comparable.

The Sunday World’s circulation stands at 130,000 down 9.4% on 2017. The publication, for the last few reports, has fallen at a greater pace than the market, but the Sunday tabloid market suffering in general. A decade ago the tabloids made up 47% of the Sunday market, today it stands at 39%

I would have expected that the Sunday Business Post would have got a better bounce from the extensive coverage they gave to Independent News and Media’s data woes and the alleged off-site scrutiny of some of its employees’ emails. But it turns out that the April number was up 3% on the previous month, less than I would have expected. They were down -5% on last year at 28,700.

Daily Star Sunday still manages to eke out a living from the Irish market managing 14,600 sales every Sunday down, but 5% on the previous year –still ahead of the market decline. The title will soon be consumed into Trinity Mirror group so interesting times ahead.

The Sun on Sunday comes in at 52,600, an ‘increase’ of 1% year on year. However, if we allow for their new found love of ‘paid multiple copies’, that figure should be closer to a decline of around -4% as they had no multiples in their 2017 figures.

The Sunday Mirror in recent years has underperformed an already underperforming market. They have managed to fare worse than the overall Sunday market and continue this theme this year. They come in at 21,100, an 8% decline on last year.

Its running mate the Sunday People also have been trailing the market of late and continue to do so. 7,700 is their number for the first six months of 2018, down 11% on last year.

The Mail on Sunday, with a figure of 62,700, is showing a top line -17% decline on the same time last year. No doubt certain elements of the media will focus on that figure without much by way of clarification of the underlying reason.

There would seem to have been a change of policy with the Mail on Sunday and Irish Daily Mail where they no longer use bulks (as of January 2018). This, for this analysis, makes a direct comparison year on year almost invalid as it’s one year with and one year without bulks. However, taking that into account, it can’t be disguised that, extracting the bulks, they are still back around -8% or -9%.

The Sunday Times comes in at 75,100 a decline of -5% year on year.

Morning Market

The morning market fell by 8.2% to 384,600 copies per day. The rate of change for the Morning market has been hovering around 8% for the last few reports and looks like there is no sign of it moving from that level.

| Publication | JJ 2018 | JJ 2017 | Diff ‘000 | Diff % |

| Irish Independent | 87,673 | 94,502 | -6,829 | -7.2% |

| Irish Times | 58,678 | 62,423 | -3,745 | -6.0% |

| Examiner | 26,085 | 28,338 | -2,253 | -8.0% |

| Daily Mirror | 30,024 | 34,158 | -4,134 | -12.1% |

| Irish Daily Star | 46,808 | 50,649 | -3,841 | -7.6% |

| The Sun | 56,206 | 55,674 | 532 | 1.0% |

| Tabloids | 133,039 | 140,481 | -7,443 | -5.3% |

| Daily Express | 2,306 | 2,517 | -210 | -8.4% |

| Irish Daily Mail | 31,710 | 41,190 | -9,480 | -23.0% |

| Daily Telegraph | 2,041 | 2,180 | -139 | -6.4% |

| Financial Times | 2,132 | 2,314 | -182 | -7.9% |

| Guardian | 2,016 | 2,191 | -175 | -8.0% |

| The Times | 6,993 | 3,728 | 3,265 | 87.6% |

| The Herald | 31,946 | 39,093 | -7,147 | -18.3% |

| Total | 384,618 | 418,958 | -34,339 | -8.2% |

The Irish Independent stands at 87,600 down 7& on the previous year. There was a small increase in their multiple copies (bulks) which now stand at 20% of their circulation. They also have 3,500 digital subscriptions which is a small increase on last year.

The Irish Times declined by -6% to 57,900 but they have 19,000 digital subscribers as well to increase their ‘brand footprint’. In the first half of 2017 they had 15,000 digital subscribers so that equates to a 26% increase in their digital base over the year.

The Examiner reported a circulation of 26,000 a fall of 8% and the Herald had a very poor first half recording an 18% fall in their circulation.

The Daily Star felt an 8% decline in circulation over the year to bring them to a circulation of 46,800. The titles faces a few hurdles in the next few months; the Irish Competition Authority carries out a phase two look at the proposed acquisition of the 50% portion of the Irish Daily by ‘Reach’ (previously known as Trinity Mirror). The other 50% shareholding is held by IN&M who have their own issues to contend with in the latter half of the year, mainly trying to deal with the Director of Corporate Enforcement. Will it all be too much for the title to contend with?

The Sun managed a 1% ‘increase’ in its numbers to 56,200. Like its sister Sunday title that was aided and abetted with a few bails of multiple copies, which were not uses in its figures last year. If the multiples were allowed for, the underlying ‘sales’ would be down around 4%, which still outperforms the market as a whole. Add to that a recent price increase, which is not included in the first six month figures as it took place at the start of July, there may be some pressure on their sales later in the year.

The Mirror had a bad six months down 12% to 30,000 and way above the market average. Overall the tabloids managed a 5% decrease in circulation and it could have closer to the market average if The Sun had not changed its policy on bulks during the year.

Like the Sunday edition, the Irish Daily Mail changed its bulks policy taking meaning it took hit of around 3,500 copies per day in the first six months of this year. The ‘decline’ of 23% looks so dramatic – but you have to take the policy change into account. Allowing for the bulks and you’d be looking at a 14% decline in sales.

I touched on the Times Ireland edition before. The grossly inflated 96% ‘increase’ is simply down to multiple copies – to the tune of 44% of their circulation in June – whereas they had no bulks last year, I’ll leave it at that.

* In the tables – the morning market includes The Herald in both years. In the figure for the overall market the Echo is added to the total. In the charts for the morning, the Herald is excluded as their move to the morning would distort the trend.